“Yeah, so Rich Dad Poor Dad told me to load my bags in 2020 due to a global supply crunch… Did I mention I also bought Nvidia early?”

If your uncle wouldn’t shut up about gold at Thanksgiving while your “internet money” was getting smoked, wait until silver hits the Christmas dinner conversation.

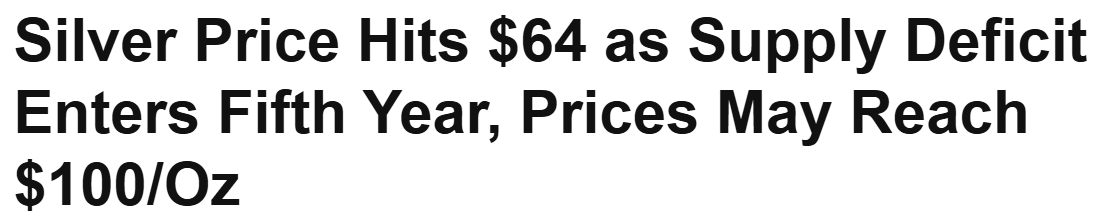

Silver just ripped past $60 an ounce for the first time ever and is having its best year since 1979… the last time inflation ran wild and investors stampeded into gold and silver.

And no, this isn’t just WallStreetBets switching meme stocks for shiny rocks again (though they definitely showed up). This rally has been spurred by a perfect mixture of:

-Five straight years of global undersupply coming home to roost

-Industrial demand going vertical

-ETF inflows piling in like it’s 2020 again

-Degens YOLO’ing call options

-J-Pow opening the money spigot

In other words: everyone showed up at once… and there isn’t enough silver to go around.

The real problem comes down to simple economics: you can’t just “make more silver”

Unlike gold, silver is mostly produced as a byproduct of mining other metals like copper and zinc.

Translation: You don’t just spin up a silver mine because prices are hot. Miners can’t exactly say, “Hey guys, silver’s mooning, let’s double production real quick.”

So while demand keeps climbing, supply is saying, “Once it’s gone… it’s gone.”

Meanwhile, inventories are doing something… weird On paper, the U.S. looks loaded with silver. For instance, COMEX inventories are sitting around 456 million ounces… roughly three times their historic average.

(Source: Carbon Credits)

Sounds bearish, right? Not really. That silver piled into New York because traders are terrified the U.S. might throw tariffs at silver as part of its Section 232 review on critical minerals.

Silver just got added to that list this year, because I guess everything (except for the Epstein files) is now a national security issue.

So silver flowed into the U.S. and out of everywhere else. China… India… and London (which just went through a silver squeeze 2 months ago).

If you’re looking for one of the clearest tells that this move is getting over its skis? As always, look to options.

Call buying on silver futures and the iShares Silver Trust (SLV) just hit the highest level since 2020 and the cost of upside bets has exploded relative to downside protection.

Translation: Everyone wants in. Almost nobody wants insurance.

According to options desks, this isn’t just hedge funds or just retail… it’s both, chasing momentum in one of the most volatile commodities on Earth.

Gold also rallied, cruising above $4,200 an ounce, but silver completely outshined it. The gold-silver ratio collapsed to 1-to-67, the lowest since 2021.

That’s traders screaming: “Silver isn’t cheap anymore… but we don’t care.”

So… is this real or is this a blow-off top? Honestly? Both can be true.

As one Daniel Ghali of TD Securities put it: “Until the lights come on, silver continues to stage an increasingly risky blow-off top.”

AKA: “This makes sense… right up until it absolutely doesn’t.”

Historically, silver moves in extremes. Calm has never been part of the program.

If you’re long silver right now… this is the part where you either take profits or learn a lesson.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned thru out the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer